Most Loans Are Reported to the Bureaus

While the credit detailing process is to a great extent beyond your control, you ought to realize that advances are regularly answered by the credit departments. Furthermore, on the grounds that advances are unique in relation to Visas, those reports don’t appear to be identical or incorporate similar properties.

Advances on favorable terms are to a great extent unimportant surprisingly scores, yet in the event that they’re late or in default, they can rebuff.

When you apply and apply for a line of credit, you consent to make installments to your loan specialists and return their cash, in addition to charges as well as revenue. Advances can be utilized to pay for houses, vehicles, boats, educational costs, and basically whatever else you might want to back. As a matter of fact, a few loan specialists don’t expect you to recognize what it is you’re purchasing with their cash.

At the point when individuals get cash as advances, almost certainly, these will be the biggest augmentations of credit they’ll at any point need to support.

Administration, in a loaning setting, means to deal with the obligation commitment by repaying it.

All augmentations of credit, whether they’re charge cards or advances, have comparable traits in accordance with credit details. Each of your records will have a record opening date, assignment of your relationship with your banks, the record type, balances, planned regularly scheduled installment sums, account situations, and your installment history.

The Type of Loan

All records are accounted for with a code that distinguishes the kind of record. For advances, the record type, better referred to officially as portfolio type, is distinguished as “Portion.”

Advances are, obviously, repaid in portions, which is the reason they are frequently alluded to as portion credits.

An illustration of a typical portion credit is a vehicle advance. At the point when you get the means to purchase a vehicle, your credit is taken care of as you make similar installments for a proper number of months.

While there are various kinds of car credits, 48, 60, and 72 months of portion installments are normal terms.

The Original Loan Amount

Your moneylenders will report the first advance to add up to the acknowledged agencies as a component of their record outfitting. Thus, for instance, assuming you acquired $40,000 to purchase a vehicle, that is your unique credit sum.

That worth won’t ever change and will be a piece of your record history as long as it stays on your credit reports.

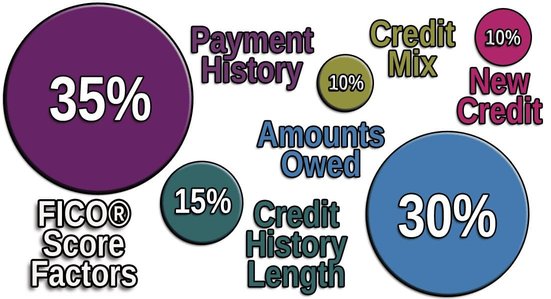

This worth is essential to credit scoring models, including those worked by FICO, in light of the fact that credit scoring computations think about your obligation. That incorporates, for instance, the amount of obligation you possess, the number of your records have balances, what your rotating obligation is versus your portion obligation, and what your ongoing adjusts are comparative with your unique credit sums.

While these are positively essential for your FICO score computations, you ought to know that the measurements that arrangement with portion obligation are not close to as significant as those that arrange with spinning obligation (Visas).

You can have six or seven figures of portion obligation yet have magnificent financial assessments. You can’t, in any case, say the equivalent regarding Visa obligation. The fact of the matter is, that you ought to never avoid portion advances since you’re unfortunate about the effect they might have on your FICO ratings.

Your Scheduled Monthly Payment

The planned regularly scheduled installment sum is, you got it, the sum you’re committed to paying the moneylender every month for the length of the credit term. The worth detailed by banks don’t change since you make a similar installment however long the credit might last.

For Mastercards, your base installment depends on your equilibrium, which can and frequently changes consistently. So one month your base installment might be $100, and the following it very well maybe $110.

How much you’re booked regularly scheduled installment isn’t viewed as in credit scoring frameworks. One normal confusion about financial assessments is that they consider all that on your credit reports, which is erroneous.

Some record data is thought of, and some record data is overlooked or “avoided.” The planned regularly scheduled installment sum is circumvented, and that implies your score can never be higher or lower due to your worth in this field.

Student Loan Disbursements

An understudy loan is an expansion of credit, regularly ensured by the central government, and used to fund instruction. Understudy loans, similarly to most different credits, are taken care of in portions (same installment for a decent timeframe).

Yet, dissimilar to different advances, understudy loans really do have a few exceptional perspectives with regard to credit details.

Student loans are typically answered to the agencies by advance servicers. A credit servicer is entrusted with dealing with the regulatory parts of your understudy loans.

So when you make your installment consistently, you’re probably paying the servicer as opposed to the real moneylender. The advance servicer is additionally the organization liable for outfitting data about your credits to the credit departments and the one that carries out examinations in instances of the contested exactness of credit detailing.

One more intriguing part of educational loan credit revealing is that understudy loan accounts are accounted for on a dispensing premise.

For those of you who took out educational loans to pay for school, you might review that you required some investment to pay for the educational cost. That is, you didn’t get four years of educational cost at the very beginning.

This means you probably have a few understudy loans showing up on your credit reports since you took different payments. This is novel to educational loans and just understudy loans. You didn’t take out different distributions to pay for your home or your vehicle.

Whether a Loan is Secured or Unsecured

While not generally exact, advances will quite often be gotten and charge cards will generally be unstable, and can be accounted for by the agencies thusly.

In a loaning setting, got demonstrates that the credit is ensured by an actual resource, like your vehicle or your home.

Gotten versus Unstable Loans

The moneylender will report whether the advance is gotten by a resource.

A few credits, including understudy loans and individual credits, are not gotten by something besides your legally binding guarantee to make your installments.

The advance’s security possibly becomes important assuming your default. At the point when you default on a got credit, the bank can reclaim the property, regularly through repossession or dispossession, and offer it to cover the exceptional and neglected balance.

As tended to above, repos and dispossessions can be accounted for by the credit authorities.

After the resource is sold, the deal continues to be applied to the excess credit balance. In the event that the credit is settled completely, that closes the cycle. On the off chance that there is an excess of assets after the credit is paid, which is interesting, then those assets are gotten back to you.

In the event that the assets are not adequate to take care of the credit, which is substantially more typical, then you will have what’s known as a lack of balance. In certain states, the lack of balance is as yet your commitment, and the moneylender can come after you for installment.

In certain states, the moneylender can’t come after you for the lack of balance. One way or the other, it very well may be accounted for by the primary credit authorities, and that announcing is viewed as offensive.