China is driving the way, however not in the manner in which you could think. China Industrial Production is the first significant economy to slow in quite a while pacing of rising, as shown by the March high in the 3/12 pace of progress. The decelerating pace of rising will characterize China’s modern economy through 2022.

Standard perusers are neither shocked nor frightened by this, as we have been estimating the 2022 log jam since March 2020, when economies moved to a pandemic-caused closure. This is definitely not an unpropitious harbinger of monetary torment, however, it is a reasonable sign of Phase C ahead at the full-scale level and for the need to change assumptions until the end of this current year and into 2022 for some organizations. In the first place, it is critical to be certain the lull will go on before legitimate activities can be set up.

Deceleration Ahead

ITR utilizes a large group of proactive factors to see the future first. The China Leading Indicator is flagging a late-2021 high in the China Industrial Production 12/12. Power age in China has areas of strength in a relationship to changes in Industrial Production, and the China Power Generation 3/12 places the Industrial Production 12/12 top in late 2021. Railroad Freight Carried is another significant proactive factor, and it joins the chorale in flagging a late-2021 China Industrial Production 12/12 high.

These pointers place the China Industrial Production 12/12 in Phase C in 2022. (Kindly see our site for extra data on paces of progress, stages, and how to utilize them to see the future and deal with your organization through the business cycle.) A normal length of the decline off late-2021 high places the following 12/12 low in mid-2023.

ITR is estimating that a decelerating pace of rising will likewise happen in the US, Canada, Mexico, Europe, and Brazil, and in generally speaking World Industrial Production.

A Clear Signal

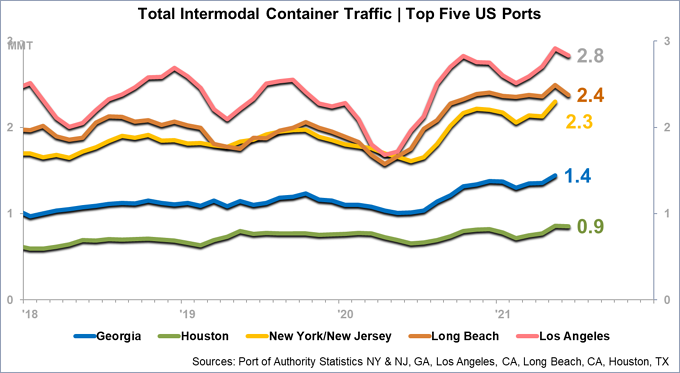

Easing back development in China now (3/12 sign) and through 2022 (12/12 standpoint), joined by easing back development in World Industrial Production in 2022, will flag a decrease in the outrageous interest pull on worldwide makers and on transportation assets. The worldwide production network will feel less strain from interest even as the stockpile side is getting. The expanded measure of Total Container Traffic getting through our five most active ports is a strong sign that supply is now moving along. Expect more gains ahead.

Organizations ought to notice the pace of progress and proactive factors for China and our gauge for worldwide deceleration in 2022 and change development assumptions likewise. A decidedly corresponded organization can expect development in 2022, however at a decelerating pace. Spending plans, creation assumptions, stock levels, and income projections ought to be considered in view of decelerating development.