The pandemic brought about worldwide abundance taking a critical dunk in the initial segment of 2020. Toward the finish of March, worldwide family abundance had proactively declined by around 4.4%.

Strangely, after much money-related and the financial boost from states all over the planet, worldwide family abundance was more than ready to recuperate, wrapping up the year at $418.3 trillion, a 7.4% increase from the earlier year.

Utilizing information from Credit Suisse, this realistic ganders at how worldwide abundance is circulated among the grown-up populace.

How is Global Wealth Distributed?

While people worth more than $1 million comprise only 1.1% of the total populace, they hold 45.8% of worldwide abundance.

| Wealth Range | Wealth | Global Share (%) | Adult Population |

|---|---|---|---|

| Over $1M | $191.6 trillion | 45.8% | Held by 1.1% |

| $100k-$1M | $163.9 trillion | 39.1% | Held by 11.1% |

| $10k-$100k | $57.3 trillion | 13.7% | Held by 32.8% |

| Less than $10k | $5.5 trillion | 1.3% | Held by 55.0% |

| Total | $418.3 trillion | 100.0% | Held by 100.0% |

On the opposite finish of the range, 55% of the populace claims just 1.3% of worldwide riches.

What’s more, between these two outrageous abundance dissemination cases, the remainder of the total populace has a consolidated 52.8% of the riches.

Worldwide Wealth Distribution by Region

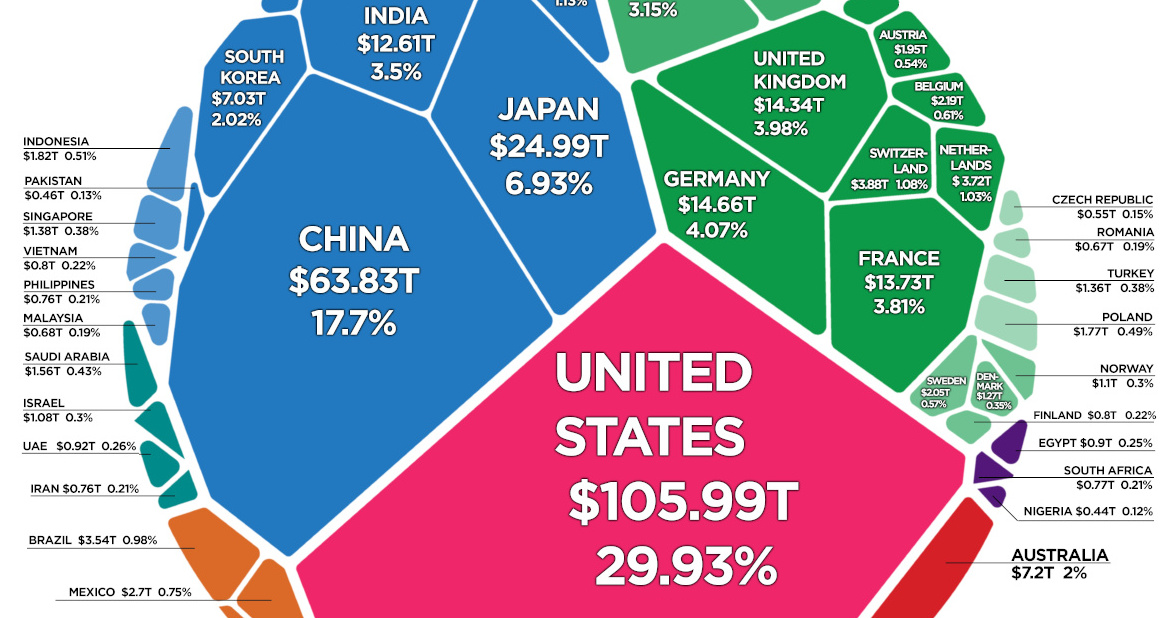

While abundance imbalance is particularly obvious inside the abundance ranges referenced over, these distinctions can likewise be seen on a more local premise between nations.

In 2020, all-out abundance rose by $12.4 trillion in North America and $9.2 trillion in Europe. These two locales represented the majority of the abundance gains, with China adding another $4.2 trillion and the Asia-Pacific area (barring China and India) another $4.7 trillion.

Here is a breakdown of worldwide abundance dissemination by locale:

| Region | Total Wealth (US$B) |

Change in Total Wealth (US$B) |

Change % | Wealth Per Adult (US$) |

Change % |

|---|---|---|---|---|---|

| North America | 136,316 | 12,370 | 10.0 | 486,930 | 9.1 |

| Europe | 103,213 | 9,179 | 9.8 | 174,836 | 9.8 |

| Asia-Pacific | 75,277 | 4,694 | 6.7 | 60,790 | 5.0 |

| China | 74,884 | 4,246 | 6.0 | 67,771 | 5.4 |

| India | 12,833 | -594 | -4.4 | 14,252 | -6.1 |

| Latin America | 10,872 | -1,215 | -10.1 | 24,301 | -11.4 |

| Africa | 4,946 | 36 | 0.7 | 7,371 | -2.1 |

| World | 418,342 | 28,716 | 7.4 | 79,952 | 6.0 |

India and Latin America both kept misfortunes in 2020.

Complete abundance fell in India by $594 billion, or 4.4%. In the interim, Latin America seems to have been the most awful performing district, with complete abundance dropping by 11.4% or $1.2 trillion.

Post-COVID Global Outlook 2020-2025

Regardless of the weight of COVID-19 on the worldwide economy, the world can anticipate powerful GDP development before long, particularly in 2021. The most recent assessments by the International Monetary Fund in April 2021 proposed that worldwide GDP in 2021 will add up to $100.1 trillion in ostensible terms, up by 4.1% contrasted with the year before.

The connection in typical times between GDP development and family abundance development, joined with the normal quick return of financial movement to its pre-pandemic levels, recommends that worldwide abundance could develop again at a high speed. As per Credit Suisse’s gauges, worldwide abundance might ascend by 39% over the course of the following five years.

Low and center pay nations will likewise assume a fundamental part in the approaching year. They are liable for 42% of the development, despite the fact that they represent only 33% of current riches.