Late proactive factors recommend that nonresidential development action will bounce back as we head into the final part of 2021 and then some.

The underlying macroeconomic slaughter welcomed on by COVID-19 in mid-2020 has waited in nonresidential development advertises hitherto into 2021. Because of nonresidential development comprising of bigger ventures that require longer arranging skylines and more capital than its private partner, this is a slacking area of the economy; it requires greater investment to ingest unsettling influences at the macroeconomic level completely. The information is demonstrating that this market is beginning to turn the corner.

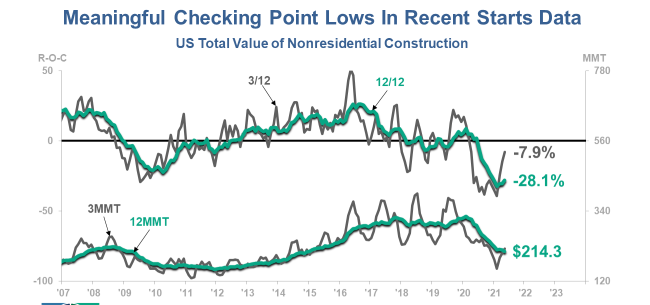

US Total Value of Nonresidential Construction Starts, distributed by ConstructConnect, has probably progressed to recuperation, a recuperation pattern that seems practical in view of proactive factor support. On an annualized premise Starts are still down 28.1% from the year-prior level, however, on a quarterly premise the draining is easing back. This is for the most part ‘on time’ with what we normally see as a one-year slack time between the US economy and nonresidential development markets, however, it can fluctuate by individual area. US Gross Domestic Product arrived at a recurrent low toward the finish of the second quarter of 2020 and promptly moved into recuperation from there on; add a year and that lands us in mid-2021, exactly on schedule.

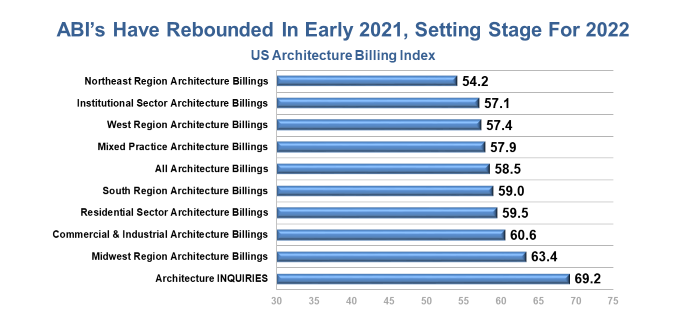

Industry explicit proactive factors are empowering too, as a general material of the different Architecture Billings Index information from the American Institute of Architects lays out a positive picture for the business.

These crude month-to-month readings are above 50.0, a dispersion record assignment that shows improvement in Billings action in the different areas from the earlier month. ITR makes the extra stride of creating paces of progress on these data of interest and connecting them to nonresidential development markets. On a pace of-progress premise we consider conclusive vertical energy to be well.

There are waiting for dangers and worries in certain business sectors, no doubt. Raised opportunities in business office space are one model, as the residue from characterizing anything that will be ‘typical’ present COVID progresses forward with settle. In any case, the conglomeration of this information focuses demonstrates expanding manufacturer and undertaking proprietor certainty and a rising tide for an area that has slacked the recuperation to this point. Anticipate that more tasks and offered possibilities should come in the quarters ahead. Focus on better fit and higher benefit potential open doors as the more slender days in the market are blurring behind us.