What Is a Roth IRA?

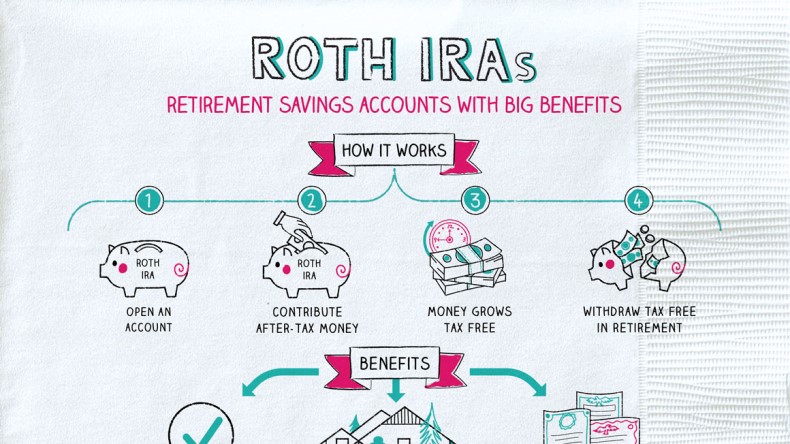

A Roth IRA is a singular retirement account where you put away cash you’ve proactively paid charges on. Because of your commitments and compound profit from returns, your cash develops over the long haul until you start to pull out it in retirement.

Not at all like a 401(k), an IRA — whether it’s a Roth or customary IRA — is a record you open all alone. It’s not a subsidiary of a business.

What makes a Roth IRA remarkable is the way the public authority charges it.

With a customary 401(k), you put your cash into the record before charges are taken out. With a customary IRA, your commitments are after-charge however you can frequently deduct them. With both of these plans, you’ll pay charges on your commitments and income at the hour of withdrawal.

Be that as it may, with a Roth IRA, you’re putting away cash after you pay charges on it and it’s not deductible. So when you arrive at age 59 ½, the Roth IRA rules let you pull out every last bit of it — your commitments and profit — tax-exempt.

Advantages of a Roth IRA

Opening a Roth IRA enjoys numerous benefits, including:

1. It’s a Tax-Free Source of Income in Retirement

Since you’re paying duties forthright, a Roth IRA is a decent choice in the event that you hope to get fundamentally more cash flow from here on out. You’ll likely be burdened in a lower charge section now than you would be in the event that your profit is higher later on. Then again, numerous retired people live on decent pay, so keeping away from duties could assist more than you suspect.

2. You Can Withdraw Your Roth IRA Contributions whenever

Since you’ve previously paid charges on your Roth IRA commitments, you can pull out those tax-exempt at whatever point you want them.

Notwithstanding, in the event that you pull out from your profit before you reach 59 ½, you’ll need to pay personal expenses on them, in addition to a 10% punishment.

3. You Don’t Have to Take Money Out

With a conventional IRA or 401(k), you’re expected to take out a specific sum — known as a necessary least dispersion (RMD) — when you arrive at age 72. The sum you’re expected to pull out relies upon your age, your future, and the amount you possess in your record.

Yet, you won’t ever need to remove cash from your own Roth IRA. A Roth IRA has no RMDs while you’re as yet alive, however, when you pass on, your record recipient might need to take them.

Note that under the CARES Act retirement controls, all RMDs were suspended for 2020.

4. An Option for People who Don’t Have a 401(k)

You really want procured pay — like compensation, time-based compensations, rewards, tips, or independent work pay — to add to a Roth or customary IRA. But since you open an IRA all alone, it’s an effective method for putting something aside for retirement on the off chance that you’re independently employed or your manager doesn’t offer a retirement plan. You can likewise utilize it to enhance your manager gave plan.

On the off chance that you have a 401(k) and need to put away cash you’ve previously paid charges on, inquire as to whether your manager offers a Roth 401(k). You likewise store these records with after-charge dollars and later pull out your cash tax-exempt in retirement.

5. You Can Use a Roth IRA for a First-Time frame Home Purchase

You can pull out up to $10,000 worth of income ($20,000 for wedded couples) from your Roth IRA punishment allowed to assist pay for a first-time frame with homing buy in the event that you’ve had the record for a very long time or more. The IRS typically thinks of you as a first-time homebuyer on the off chance that you haven’t possessed a home in the beyond two years, however, as far as possible is for your lifetime.

6. … or College Expenses

You can pull out profit punishment free assuming that you utilize the assets to pay for school or other advanced education — for yourself’s purposes, your kid, or your life partner. However, you’ll in any case owe annual assessments on the profit.

7. It Offers a Safety Net

You could possibly utilize Roth IRA assets to pay for clinical costs that surpass 7.5% of your changed gross pay in 2020 or to pay for your medical coverage charges assuming you’ve asserted joblessness pay for in excess of 12 sequential weeks.

In the event that you become an all-time handicapped, you can likewise utilize the cash from your Roth IRA to assist with your costs.

8. There Are No Age Limits

With a conventional IRA, you can’t make commitments once you arrive at age 72, yet there is no age limit for adding to a Roth IRA.

Disservices of a Roth IRA

While there are many advantages to opening a Roth IRA, there are likewise a few disservices to consider. The following are a couple.

1. You Don’t Get an Upfront Tax Break

Not at all like a conventional IRA, a Roth IRA doesn’t lessen your available pay, so you end up paying more in charges now. Your tax cut comes when you arrive at retirement age.

2. You Can Only Contribute $6,000 per Year assuming You’re Under 50

The 2021 Roth IRA limit on commitments is $6,000 — in a Roth, conventional, or both. In the event that you pick a customary and a Roth IRA, your commitment limit is $6,000 all out, so it depends on you to choose how to disperse that cash between your records.

That cutoff goes up to $7,000 once you’re 50 or more established, permitting you to offer quicker to your retirement store.

3. You Can’t Contribute to a Roth IRA in the event that Your Income Is Too High

The IRS changes the pay necessities every year. For the charge year 2021, you should make under $125,000 yearly as a solitary duty filer to contribute everything. From that point, the sum you can contribute deliberately gets rid of. On the off chance that you make more than $140,000, you’re not qualified to add to a Roth IRA.

Assuming you are hitched documenting mutually, your commitment limit begins to go down on the off chance that your joined pay is more than $198,000, and you’re ineligible on the off chance that your payment is more than $208,000.

4. You Have to Set It Up all alone

Not at all like a 401(k), which your boss sets up for you, a Roth IRA is a record you open all alone, so you need to do your own exploration about what to put resources into or find support from a monetary counsel.