Supply affixes are as yet battling to find requests emerging from pandemics, and that couldn’t be more evident for the car business. Deficiencies of data sources, for example, semiconductor chips and related gadgets, have driven car makers to slow creation and left seller parts desolate, driving up the costs of both new and utilized vehicles. The US Consumer Price Index for New Cars has risen 3.1% during the most recent year. While this might appear to be unexceptional at face esteem, it is critical given that New Car Prices have been basically level starting around 2012. The US Consumer Price Index for Used Cars and Trucks is up a stunning 29.7% throughout recent months.

What does the information tell us?

US shoppers have bought 16.147 million light vehicles in the year through December, 0.709 million units underneath the pre-pandemic level. By correlation, North American vehicle makers have just created 14.591 million units during this time period, 1.592 million units underneath the pre-pandemic level. While US customers buy vehicles created beyond North America and North American makers sell outside the US, the information is regardless illustrative of the surprising hole in market interest. That hole has brought about the stock accessible at vendor parts just being sufficient to cover a record-low 28 days’ worth of deals. Conversely, in the five years preceding the pandemic, sellers had somewhere in the range of 55 and 92 days worth of stock sitting on their parts.

New and utilized vehicle vendors have had the option to order greater costs given the absence of stock accessible for procurement. Notwithstanding, the volume has been compelled, hurting makers and shoppers the same. For instance, Ford’s June deals on F-Series pickup trucks were down almost 30% from the past June as shoppers battled to track down trucks to buy.

What’s the standpoint for the Automotive Industry?

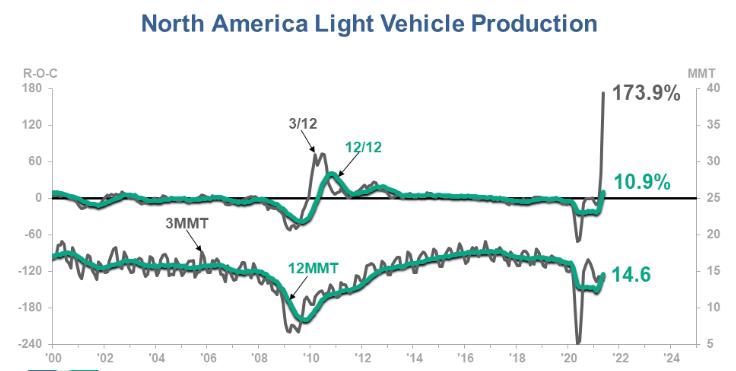

North America Light Vehicle Production has likely entered Phase B, Accelerating Growth, of the business cycle. Presented beneath you will see that 12/12 – the latest a year of Production comparative with the earlier a year, communicated as a rate – is at 10.9%.

The 3/12 – the latest three months of Production comparative with those equivalent three months one year sooner, communicated as a rate – is at a noteworthy 173.9%. This is a positive ITR Checking Point™ that recommends more potential gain business cycle energy in the approaching quarters. Notwithstanding, it is essential to take note that the year-moving aggregate (the primary concern on the graph) is at 14.591 million units, which is well beneath the pre-pandemic level, to not express anything of the 2017 record high of 17.806 million units.

In North America, we plainly have not “completely recuperated” from the misfortunes because of the pandemic. In light of the proceeded issues with chip deficiencies, it is improbable that we will return to 2019 levels during the final part of this current year. Kindly see our ITR Trends Report™ every month for the three-year figure for North America Light Vehicle Production and how it affects your business.