Kinds of obligation solidification programs

There are basically three types of obligation union projects:

- Not-for-profit obligation solidification

- Obligation solidification credits

- Obligation settlement

In the event that you are battling to take care of obligation, have different kinds of obligation, your obligation has exorbitant financing costs, you need better reimbursement terms, as well as you have sufficient pay to pay for your obligation however need assistance making and adhering to a spending plan, you ought to consider nonbenefit obligation solidification or a combination credit.

Both nonbenefit obligation solidification and union credits can:

- Get you a lower loan fee

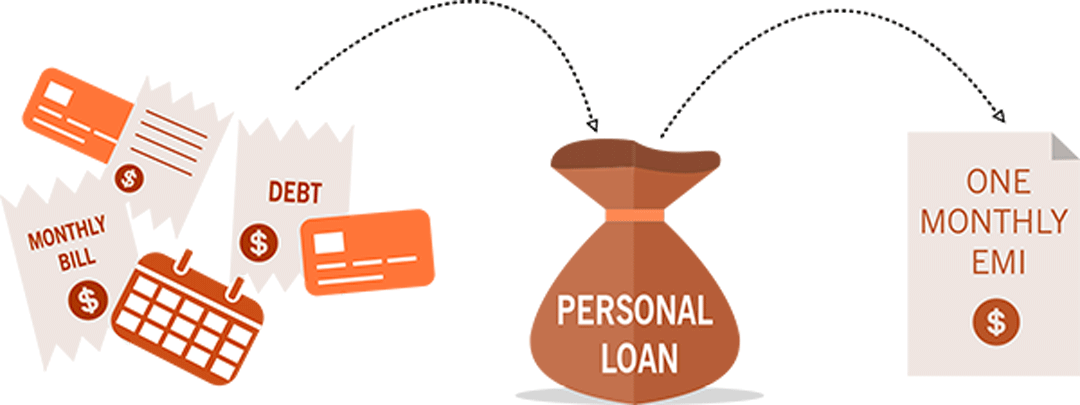

- Consolidate your regularly scheduled installments into one

- Offer better reimbursement terms so you can take care of your credits quicker

- Make your obligation more reasonable

Obligation repayment ought to possibly be a choice when your obligation has reached unmanageable levels and you’ve attempted alternate ways of escaping obligation. At the point when you settle your obligation, a leaser consents to acknowledge not exactly the sum you owe as full installment. While this prevents debt enforcement organizations from reaching you and disposing of your obligation, it can likewise obliterate your credit and require quite a while to reach.

How do obligation union projects function?

Obligation union projects are not quite the same as credits or different techniques for combining. These projects are a help presented by a credit directing organization or association. For this situation, you’d make a solitary installment to the organization, and they would send your installment to leasers.

At the point when you work with a credit guiding help, you set up a framework to kill your obligation north of three to five years. You’ll begin with advising meetings so the organization can more readily comprehend on the off chance that they can help you, find out about your obligation, and offer you the chance to pose any inquiries.

Remember combination programs just work for uncollateralized debt, for example, Mastercards, individual credits, and understudy loans. Auto or home credits probably don’t qualify.

You’ll probably then pay an arrangement expense, and be charged month-to-month expenses for the help. Your advances will exist where they are present, so you’re not moving obligations around, however, the assets you pay to your specialist co-op are appropriated to your banks. They work straightforwardly with your banks during the cycle and keep in mind that in a perfect world you’ll pay less on your credits every month, you’ll, in any case, need to pay the administrative expenses for the supplier.

What to search for in an obligation union program

While there are advantages to utilizing an obligation solidification program to pay off and escape obligation, you ought to be wary of credit fix and obligation result tricks. Assuming a deal or program sounds unrealistic, it probably is.

While looking for an obligation union program, a couple of things to focus on include:

- Whether the office is not-for-profit or for-benefit.

- Client assistance. They ought to give you unmistakable responses to your inquiries and have the option to give a record of progress. Peruse the web and client surveys to comprehend how they treat their clients. They ought to likewise offer some kind of schooling administration to assist you with making an arrangement for staying away from obligation later on.

- Pay. In the event that the guides get rewards for selling extra administrations, or attempt to talk you into things you may not require, they might be a trick.

- Cost of charges.

- Their site ought to give data like how long they’ve been doing business, program choices, expenses and charges, program time period, qualification necessities, and company contact data.

Then again, things to keep away from include:

- Organizations who guarantee not-for-profit status when they are really for-benefit.

- Assurances to settle your obligation.

- Requesting charges for administration prior to agreeing with leasers.

- Forceful selling.

- A commitment to “convenient solution” arrangements.

How the public authority assists with the obligation

The public authority doesn’t support obligation alleviation programs like obligation union organizations straightforwardly, however, it offers a few types of monetary assistance.

- Guideline: The Federal Trade Commission (FTC) has necessities for obligation repayment organizations and obligation assortment offices. The Consumer Financial Protection Bureau (CFPB) acknowledges objections against monetary organizations attempting to unreasonably treat clients.

- Military help part help: The Servicemembers Civil Relief Act lets veterans and well-trained military individuals fit the bill for lower loan costs on Mastercards and home loans, and offers other monetary insurances.

- Obligation pardoning: Government obligation, rather than obligation owed to a privately owned business, can be excused. You might have the option to settle your duty obligation for short of what you really owe the IRS. You can likewise have understudy loan obligation excused, dropped, or released, contingent upon your circumstance.

- Interest derivations: Certain sorts of interest are charge deductible, remembering interest for educational loans, home loans, and hospital expenses.

- Government Housing Administration (FHA) credits: Mortgages protected by the FHA have lower upfront installments than different advances. In the event that you have this sort of home loan, you could likewise consider an FHA smooth-out renegotiate.

What are charitable obligation combination programs?

With not-for-profit obligation unions, organizations offer free credit directing meetings and then, at that point, give decisions on how to take care of your particular obligation issue. Choices incorporate repayment plans, obligation solidification credits, obligation the executive’s programs (DMPs), and in the worst situation imaginable, chapter 11. These arrangements permit you to kill obligation without applying for a new line of credit.

Not-for-profit versus for-benefit obligation combination associations

Philanthropic obligation solidification associations face stricter principles and are held to better expectations by the public authority than for-benefit organizations. The top charitable organizations have a place with the NFCC and are certified by the Council on Accreditation (COA).3 NFCC individuals should maintain the COA’s prescribed procedures, including:

- A yearly review of working and trust accounts

- Being authorized, reinforced, and protected

- Giving purchaser schooling programs

- Meeting FTC shopper divulgence necessities

- Making administrations accessible to everybody, no matter what their capacity to pay

Rules for philanthropies

Philanthropic associations should observe a few guidelines and rules to keep up with their 501(c)(3) status.

- Exercises shouldn’t help anybody partnered with the association, similar to board individuals, chiefs, and so forth.

- Exercises likewise shouldn’t serve private interests

- Campaigning must be tempered; associations can’t back political up-and-comers

- However not burdened, philanthropies should report specific data to the IRS every year, per the Internal Revenue Code

- Can’t acquire irrelevant business pay in abundance

Knowing the distinction

There are a lot of organizations out there hoping to exploit customers. In any case, there are ways of differentiating between charitable obligation union associations and other obligation alleviation organizations.

- All NFCC members are charities

- Philanthropies will not have forthright expenses

- Check with the Better Business Bureau4

- Ensure the organization is authorized in your state by checking with the principal legal officer or shopper security department

- Exhaustive credit and financial plan guidance are totally free through charities

Handy solutions are warnings

Characteristics that the best not-for-profit obligation union organizations have

Search for these characteristics in an obligation solidification organization:

- Credit bills are consolidated into one installment, making reimbursement more straightforward

Capacity to take care of obligations quicker - Lower financing costs, regardless of your FICO assessment

- No more assortment calls

- A sensible, simple to-follow financial plan/monetary arrangement

- A low month-to-month expense, commonly $25-50, to keep up with and handle your record. This expense can be deferred assuming you can’t manage the cost of it.

- Autopay is deducted straightforwardly from your financial balance to keep away from late installments

Straightforwardness no matter how you look at it: expenses, qualification, and so forth. - Upsides and downsides of obligation solidification programs

- Similarly, as with all choices to dispose of your obligation, there are advantages and disadvantages of obligation union projects.

Aces of obligation solidification programs

These projects are not a credit, so your FICO rating doesn’t factor into your capabilities.

Diminished loan fees can assist with bringing down regularly scheduled installments.

Creating installments on time can assist with further developing your financial assessment.

A credit guide can assist you with fostering a month-to-month financial plan.

Training projects can assist you with laying out monetary objectives and making an arrangement for avoiding obligations.

Cons of obligation solidification programs

You should in any case make all regularly scheduled installments on time, or change your program getting dropped.

You’ll probably be charged an arrangement expense, as well as month-to-month administration charges.

You’re expected to quit utilizing all Mastercards.

Which obligation solidification program is appropriate for me?

Picking the right obligation combination program can appear to be overpowering, so carve out an opportunity to investigate and figure out your choices. It’s vital to pick a program that you feel OK with and trust and will offer the arrangements you really want to escape and avoid the obligation.

While investigating programs, ask your companions or family, read audits, and explore the supplier broadly on the web. Know about any warnings and stay away from those suppliers. You can likewise take a stab at reaching your lenders to learn of any help they might give.

Elective obligation combination choices

Different choices for obligation combination incorporate the accompanying:

- Individual advances

- Balance move charge cards

- Home value advance

- HELOC (home value credit extension)