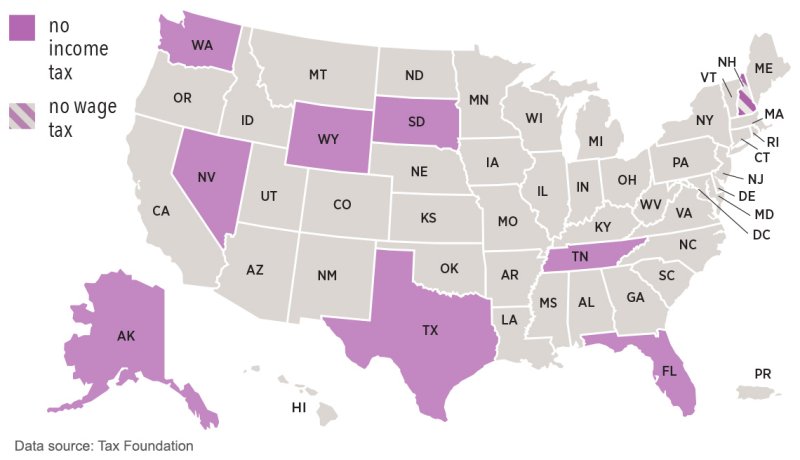

What states have no annual duty?

The Frozen North

The Frozen North is a duty critic’s heaven. In addition to the fact that occupants appreciate zero state annual duty, however, they don’t pay state deals charges by the same token.

At the point when you think about state and nearby states — including extract charge, deals charge, and local charge and that’s only the tip of the iceberg — Alaska has the most reduced general taxation rate in the nation, as per the not-for-profit Tax Foundation.

Occupants likewise get a yearly installment from the Alaska Permanent Fund Corporation as a portion of the state’s regular assets. This emerged to $1,114 per individual in 2021.

However, try not to get excessively invigorated. High lodging, food, energy, and medical care costs make it the 6th most exorbitant state to call home, says the Missouri Economic Research and Information Center.

Florida

Americans don’t simply relocate to Florida for the sake of entertainment in the sun. It flaunts the eleventh least taxation rate in the country.

Florida is so hostile to annual duty that citizens changed the state constitution in 1924 to banish the state from ordering one.

The state government recovers a lot of its lost income through a significant deals duty of 6%. When joined with the city, district, and nearby charges, the expense of the all-out deal can be just about as high as 8%.

That stings for local people, however, it likewise assists Florida with pressing sightseers who rush to the state’s numerous attractions.

Nevada

Nevada doesn’t have individual pay, corporate pay, or legacy burdens, and its local charges are among the least in the country.

How can it compensate for its setback?

The Silver State is another significant vacationer location that channels local people and travelers the same through the seventh-most elevated state deals charge in the country and the 6th most noteworthy gas charge.

Home to Las Vegas, known as Sin City, Nevada likewise rounds up a significant measure of its income through “wrongdoing charges” on tobacco, liquor, and betting.

New Hampshire

This one is nothing unexpected. The state with tags that say “Carry on with total freedom or Die” is about little government and low duties.

New Hampshire doesn’t burden inhabitants’ wages and has no state or nearby deals charge.

It exacts a 5% duty on pay from profits and premium, yet the state intends to progressively eliminate this expense too, lessening rates by one rate point consistently until nixing them totally in 2027.

To compensate for it, New Hampshire’s meat and potatoes are local charges. Property holders pay the third-most elevated rate in the country, as per the Tax Foundation.

South Dakota

South Dakota, home to the beautiful Mount Rushmore, is well known for multiple lovely countenances.

The state hasn’t seen annual expenses starting around 1943. Legacy and home assessments are likewise nonexistent, and generally, South Dakotans partake in the fourth-most minimal state and nearby taxation rate in the country.

Similarly, as with numerous other zero-annual expense states, South Dakota pays for fundamental administrations with charges on liquor, tobacco, and fuel. Genuinely high local charges place it in the top portion of states.

It likewise took action against internet shopping, winning a 2018 Supreme Court choice permitting it to compel web retailers to charge deals charges, as well.

Tennessee

Tennessee as of late joined the crew of annual tax-exempt states.

The Volunteer State used to charge a “Lobby personal expense,” which applied exclusively to speculation and interest pay. In any case, that assessment was totally gotten rid of by Jan. 1, 2021.

Today, it has the third-most reduced state and neighborhood taxation rate in the country.

Notwithstanding dispensing with annual expenses, it’s not difficult to see where state government financing comes from. Tennessee occupants pay an astounding 7% state deals charge, the second-most noteworthy in the country. Then, at that point, add on a normal nearby deals charge pace of 2.55%.

The state is likewise known for high sin charges and leads the country with a $1.29-per-gallon lager extract charge.

Texas

There’s no state annual expense in Texas, and except if the state’s constitution is corrected, there never will be. This incorporates corporate annual assessment, individual personal expenses, and even retirement pay.

Texas compensates for its absence of annual duties by charging higher-than-normal deals and local charges. Customers pay a normal of 8.20% for nearby and state deals duty, and Texas has the 6th most noteworthy local charges in America.

Generally, in any case, life in Texas is very reasonable. The Lone Star State has the fifteenth least cost for most everyday items in the nation, making it the most reasonable state with no annual charges.

That is one valid justification why Texas is blasting. The state’s populace is becoming quicker than some others, and it was additionally the No. 1 state on U-take’s movers’ review.

Washington

The Evergreen State doesn’t burden individual or corporate pay, however, it requires a 7% expense on the capital increases of high workers.

Or possibly, it’s attempting to. In March, a regional court controlled the capital additions extract charge as unlawful. The case is going through requests, so the truth will come out eventually the way that long this assessment endures.

In Washington, the public authority takes its cut by charging the fourth-most elevated deals charge, when normal neighborhood charges are considered.

Gas is intensely charged at $0.49 per gallon — No. 8 from one side of the country to the other — however, that isn’t anything contrasted with the expense on liquor. Refined spirits are charged at a pace of $35.31 per gallon, undeniably more than some other states. Oregon is a far-off second at $21.95 per gallon.

Wyoming

Nicknamed “The Cowboy State,” Wyoming’s free-living boondocks history radiates through with no private, corporate, or retirement annual assessments.

Dissimilar to different states without personal charges, Wyoming doesn’t gouge inhabitants with different duties to redress. It has the second-most minimal state and nearby taxation rate in the country at 7.5%, dominated simply by Alaska.

What income it needs, it gets from deals charges. Yet, at simply 5.22%, considering normal nearby deals charge, it’s actually lower than by far most of the different states. Local charges are additionally among the least in the country.

With negligible expenses, a below-the-norm typical cost for most everyday items, and strong pay rates, Wyoming is one of the most incredible states for keeping your well-deserved cash in your pocket.