The Federal Reserve raised the government subsidization target rate by 75 premises focusing on June 15. The financial exchange appeared to be satisfied with the endeavor to subdue expansion. That didn’t keep going long, with the S&P 500 dropping 3.7% the extremely following day.

Downturn fears are amped up; one perspective is that the Federal Reserve will push loan fees excessively high and make a downturn as they attempt to get rid of expansion. We absolutely figure out the apprehension, and the Fed’s history is not exactly heavenly. In any case, going down that logic might be giving the Fed credit for the power they don’t have. Or on the other hand, they have more insight than the commercial center is as of now crediting to them. The graphs underneath give an expectation and cause for idealism.

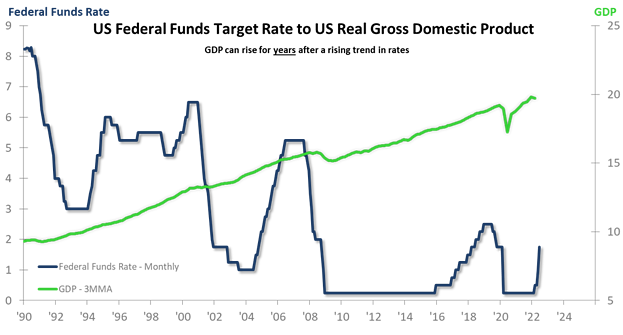

The primary graph demonstrates the way that the Fed can push (and has pushed) loan costs up for quite a long time before the economy, as estimated by GDP (adapted to expansion), slows down as well as declines. As a sidebar, it is intriguing to take note that the Fed tends to quit raising financing costs before the genuine downturn starts, yet that doesn’t mean they don’t drive their mission excessively far.

Our essential focus point from the verifiable record is that the close-to-home connection between increasing loan costs and a business cycle downturn is reasonable, yet a great many people misunderstand the planning of the relationship. On this occasion, since customer monetary records are in serious areas of strength (in light of Federal Reserve information), a more limited than-typical lead time to a downturn isn’t plausible.

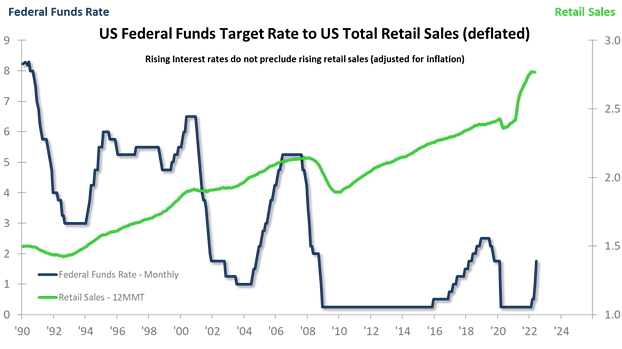

The following slide analyzes the government subsidizes rate pattern to US Total Retail Sales (adapted to expansion). We see that Retail Sales will ascend for a really long time after the Fed begins pushing rates higher. Steep climbs happened before. They were not quickly ruinous.

A confounding variable for us at present is the unusual ascent before 2021 coming from the outrageous upgrade given by Congress and the Fed because of the pandemic. The Retail Sales 12MMT information pattern has evened out off. The feelings quickly leap to bind that levelness to increase loan fees. The more plausible truth is that the withdrawal of counterfeit excitement has more to do with the new absence of ascending in the Retail Sales 12MMT. A re-visitation of business as usual will be a cycle that includes more slow Retail Sales development than we saw in 2021.

ITR gauge that this level spot would happen. We think the Retail Sales 12MMT will be somewhat down/somewhat up into the final quarter of 2022 preceding a more sure pattern produces for 2023. We don’t believe that we out of nowhere live in a universe of prompt circumstances and logical results with regard to financial matters. There is no proof past the close-to-home association that our reality has changed that much.

The above doesn’t imply that all areas of the US economy will proceed to ecstatically fill in the years promptly ahead. For example, lodging is more interest delicate; it is likewise a proactive factor to GDP. We are reconsidering our US Housing Starts standpoint in view of the most recent climb and coming about pattern probabilities. It is potential we might have to bring down our ongoing estimate for Housing Starts through 2024. Past home loan rates, there are socioeconomics, inventories, and speculation purchasers to consider.