The Federal Reserve is downshifting from unmistakable improvement to a more ordinary strategy position. This might not have the impact that certain individuals are expecting, and not along with the timetable, others are anticipating. Knowing the probabilities of the adjustment of strategy ought to assist us with all preparation with certainty for the year ahead.

The outline underneath delineates the shift from emotional excitement. The pace of progress ascend for the M2 Money Supply is portrayed on the upper part of the diagram (scaled on the left), and the M2 month to month and yearly normal information climb is introduced on the lower piece of the graph (scaled on the right); when COVID struck, the ascent was sharp for both. All that cash made it into individuals’ hands and animated requests past what the inventory network might actually adapt to.

The later information has the paces of progress, however still very raised, pushing toward ordinary levels, and the month-to-month information and 12MMA pattern evening out of. The patterns mirror the Federal Reserve’s getting back to typical development mode. The inquiries that emerge are:

- What’s the significance here for general financial development in 2022?

- Will the getting back to typical hurt retail deals?

- How should this move influence expansion?

- What does the post-boost act mean for loan costs?

How the strategy shift affects generally monetary development

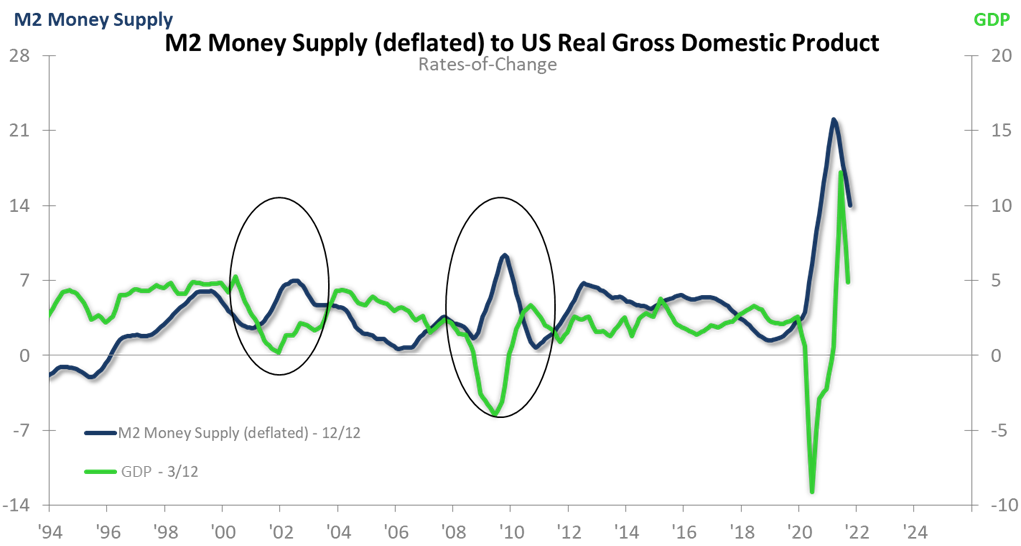

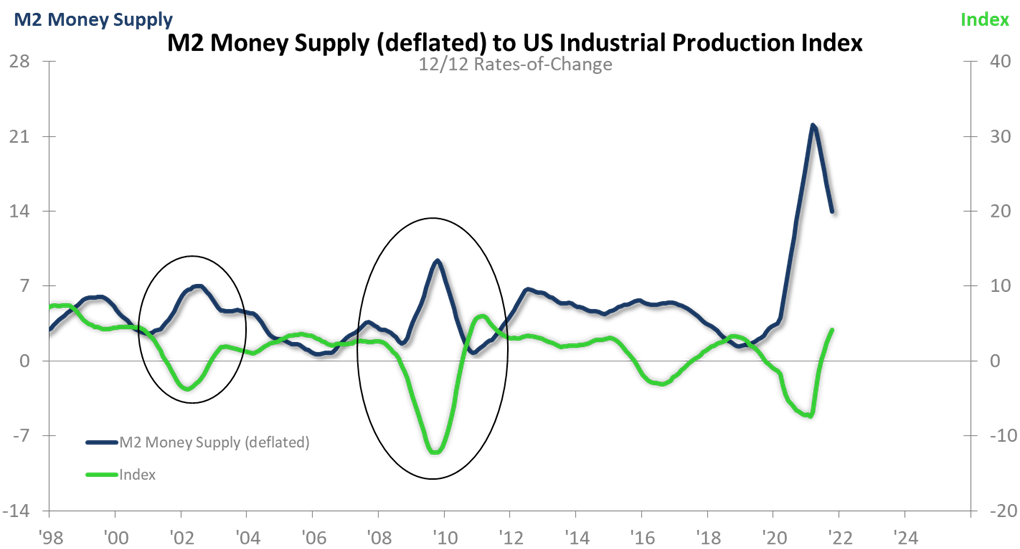

The primary diagram beneath analyzes the M2 12/12 pace of progress pattern to development in GDP (utilizing the GDP 3/12 pace of progress). Both series are in expansion changed dollars. The subsequent diagram looks at M2 as a more modest cut of the general economy, Total Industrial Production. We circumnavigated the post-boost period for every one of the last two significant downturns that got perceptible reactions from the Fed: 2001-2002 and 2008-2009.

Note that in the two cases the quick and more sensational bounce back in the development rates for GDP and Total Industrial Production gave way to more humble development (as confirmed by a decrease in the particular paces of progress). We are expecting something very similar for 2022. The development will go on for GDP and Total Industrial Production, yet at a more slow speed than in 2021. Additionally significant: post-downturn recuperations for Nondefense Capital Goods New Orders (barring airplane) kept on areas of strength for displaying patterns soon after the withdrawal of boost.

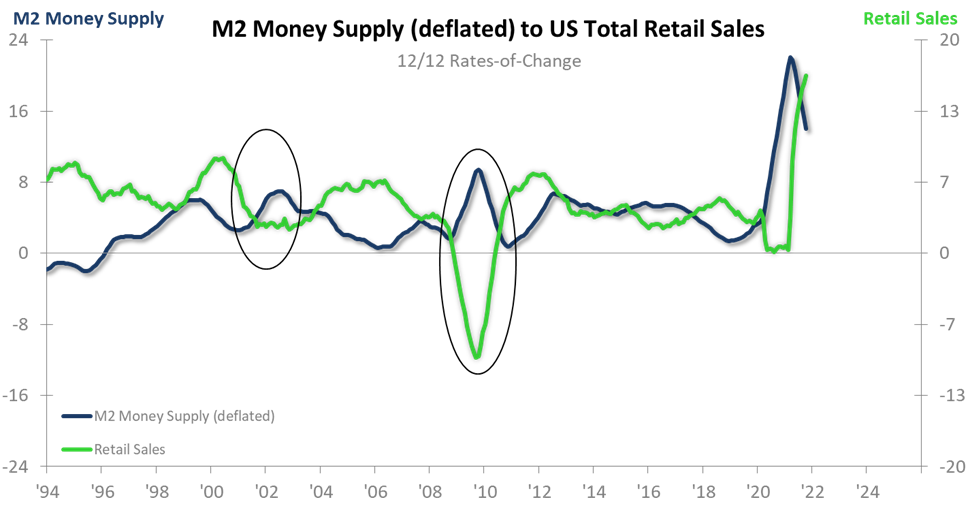

Retail Sales and the evacuation of M2 improvement

The diagram beneath shows that the two prior examples of money-related improvement withdrawal unfavorably affected the development pace of Retail Sales (ostensible dollars), the last option being such key support of our economy. In both earlier occurrences, Retail Sales got back to a typical to-marginally raised the pace of development – sufficiently able to keep the economy developing. We expect a similar will be valid in 2022. The issue is apparently made more complicated in 2022 attributable to quick wage increments and work support/quit rates;

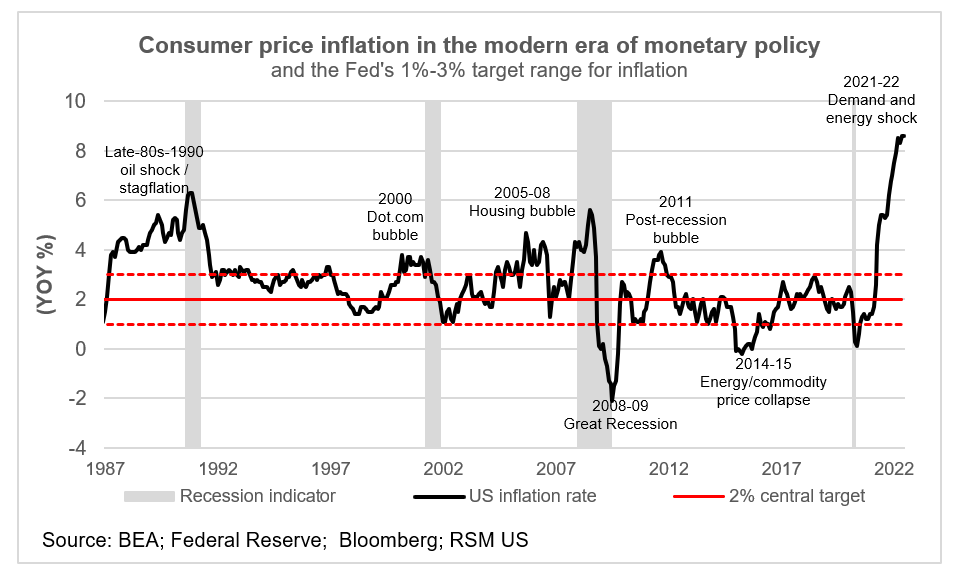

Try not to expect the arrangement shift to mean expansion will disappear

The following diagram shows that the descending change in M2 had a somewhat close term however impermanent disinflationary influence on the economy, as estimated by the Consumer Price Index 1/12 pace of progress (CPI). We expect a similar will happen in 2022. The ongoing expansion rate will probably top, with the pace of progress then moving lower. That implies less expansion (i.e., disinflation). Nonetheless, assuming you have seen our expansion figure, you realize that we expect the disinflation will be impermanent, with a totally different round of high expansion hanging tight for us working together with the following industry cycle (post mid-2023). The ongoing episode of expansion will briefly decrease, however, the monster will be back.

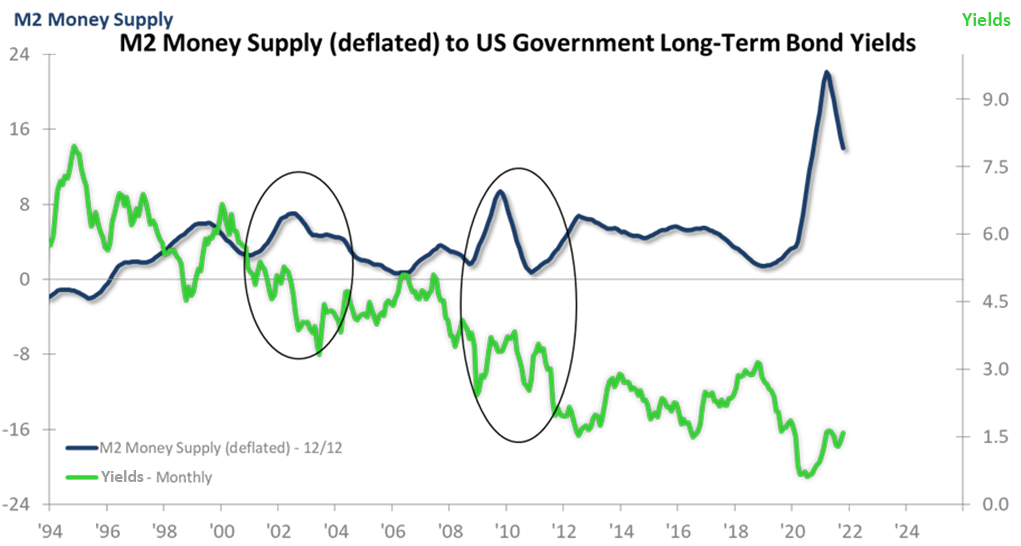

Financing costs will rise, yet insufficient to hurt the economy (until further notice)

The shared characteristic of the adjustment of long haul loan fees, as addressed by US Government 10-Year Bond Yields (month to month information), is that there might be some close-term potential gain changes in long haul rates, yet insufficient to be hurtful to the economy’s possibilities for development. The more burdensome possibilities for loan cost rise come in 2024-2025, and the circumstance is probably going to be exacerbated by deficiency spending, which will add increasingly more to our public obligation later on. We will encounter higher financing costs, yet not when certain individuals are thinking. We have the opportunity and willpower to make the most of the ongoing low financing costs and put resources into our organizations to:

- Further, develop efficiencies

- Reinforce our market position

- Move into new business sectors preceding the likely 2026 downturn